Make a Few Bucks from China’s Electric Car Dominance

In 2010, I did something that resulted in a lot of investors giving me a lot of shit.

I had the audacity to recommend an electric vehicle (EV) stock to a group of investors who thought the mere idea of electric cars was synonymous with overzealous treehuggers and wealthy eccentrics. Nothing more. They called them glorified golf carts, claimed they’d never work in real-life situations (whatever the fuck that means), and no one would buy them.

But I spent the good portion of a year researching this young and burgeoning EV market before recommending this EV stock. I visited battery manufacturing facilities, met with the chemists that were designing these batteries, and had multiple sit-downs with the management teams of a few young electric car companies that barely had enough cash to survive for more than six months at a time.

One of those companies was Tesla (NASDAQ: TSLA), and that was the stock I recommended back in 2010, right after it went public. Those who took my advice made an absolute fortune. In fact, a $5,000 investment in Tesla at that time would be worth nearly $753,000 today. That ain’t chump change.

The fact is, that was one of the best recommendations I ever made. And despite Uncle Elon’s support for perhaps the most despicable president we’ve ever had, you can’t discount what he did to the automobile industry.

Make no mistake: without Musk or Tesla, there would be no electric vehicle market today. In fact, it was because of Tesla’s success that the rest of the auto industry reluctantly started making electric cars, too.

And while I understand how a lot of people have negative feelings about Musk these days (believe me, I understand), you can’t deny that Tesla instigated the adoption of a cleaner form of personal transportation that has resulted in very real environmental benefits.

Corey Cantor from Bloomberg penned a piece on this, writing …

When it comes to lifecycle emissions, the answer is a resounding yes. According to a new report by BloombergNEF, in all analyzed cases, EVs have lower lifecycle emissions than gas cars. Just how much lower depends on how far they are driven, and the cleanliness of the grid where they charge.

If you want to dive into the data on this, here’s a link to Cantor’s analysis: https://about.bnef.com/blog/no-doubt-about-it-evs-really-are-cleaner-than-gas-cars/

Now Tesla is no longer in my portfolio, but that doesn’t mean I don’t believe the company is valuable. Even with sales in the shitter this year, it’s still a solid contender in the EV market, and really the auto market in general.

But the fact is, there’s too much uncertainty about the company’s ability to grow in any significant measure this year, particularly as competition in China continues to rapidly eat up global market share.

The Future of Transportation will be Made in China

Today, China dominates the global EV market. In 2024, the Middle Kingdom controlled 62% of global EV production. And while EVs claim about 8% of the U.S. market for passenger vehicles, in China, EVs account for more than 50% of all new car sales.

Of course, in order for China to maintain its dominance, it has to expand outside of China. And that’s exactly what Chinese EV makers have been doing. Particularly a company called BYD (OTCBB: BYDDY), which recently announced that it expects to sell half of all its cars outside of China by 2030. And it’s off to a good start.

While the company can’t sell its vehicles in the U.S. because both Biden and Trump placed overzealous tariffs on those vehicles, it can, and is, selling its electric offerings in plenty of other markets eager to get “more affordable” EVs on the roads. Which is exactly what BYD provides.

Today, BYD actually sells its cars in more than 70 countries today, with its top export markets in Brazil. Australia, Mexico, and Thailand.

While there are plenty of folks in the U.S. who have never heard of BYD, the company is now the third best-selling car brand in the world, beating out Honda, Hyundai, Ford, and Nissan. Only Toyota and VW ranked higher in 2024. And today’s data indicate that in 2025, BYD could overtake VW.

To put into perspective just how fast BYD is growing and increasing sales, in 2019 it was the 49th best-selling car brand in the world. In just 6 years, BYD went from being the 49th best-selling car brand in the world to the third. That’s insane!

Worth noting: BYD no longer manufactures conventional internal combustion vehicles, either. Just EVs and hybrids. Indeed, the writing is on the wall, and the future of personal transportation will be dominated by EVs, and most likely, BYD.

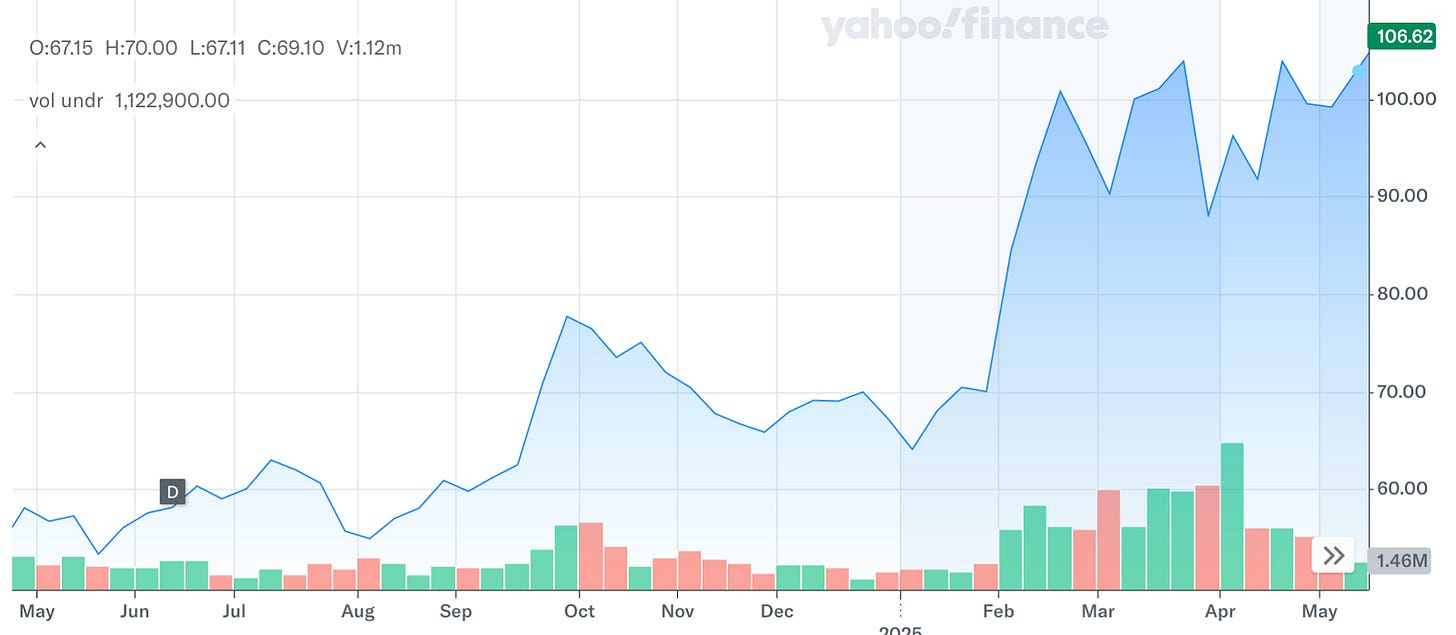

Now I recommended BYD as a buy back in 2024 with a buy price of $51.98. Today, the stock is trading at around $106.00.

It’s more than doubled inside of one year!

At $106.00, it’s basically trading right around where it should be, so I’m not recommending you go out and buy shares at these levels. But if we run into another major market correction, and the stock slips below $95, it could be worth a look. If this happens, I’ll let you know whether or not it’s a good time to buy it. Given the right market conditions, BYD could easily cross $120 a share this year.

What I’m reading

Beginning today, I’m going to start including links to some of the articles I’ve been reading as they pertain to the content I share with you. Here are some worthwhile reads about BYD and the EV market …

BYD Enters Romania, Expanding its European Ambitions: https://insideevs.com/news/759289/byd-enters-romania-european-ambitions/

BYD tops Singapore vehicle sales so far this year, replacing Toyota: https://finance.yahoo.com/news/byd-tops-singapore-vehicle-sales-061953929.html

1 in 4 Cars Sold in 2025 will be EVs: https://electrek.co/2025/05/13/1-in-4-cars-sold-in-2025-will-be-evs-and-thats-just-the-beginning/